U.S. Employees In Puerto Rico And Territories Face Huge Pay Gap

Just because they live in a ‘non foreign area’

United States (U.S.) employees and retirees residing in Puerto Rico and other so called ‘non foreign areas’ have received less pay and notably less benefits since 1994 when compared to their counterparts residing in the 48 contiguous states and the District of Columbia.

The discriminatory pay gap is explained on a legislative plan, which states that around 26,000 families are directly affected by this inequity. Among them are the families of 14,000 current federal employees, and 9,500 retirees. These federal employees stem from various U.S. agencies like the Postal Service, Homeland Security, Department of Justice, and the Armed Forces.

As a consequence of 25 years of significantly less pay raises and less benefit accruals, the amount by which federal salaries in Puerto Rico during 2019 will lag behind federal salaries in the contiguous U.S. is approximately $100 million.

‘These are amounts that have been withheld from the Puerto Rico economy, depressing Commonwealth tax revenues and adversely affecting all Puerto Rico citizens,’ states the analysis of the aggregate effects of this discriminatory practice, as written by former U.S. congressman, George Nethercutt, and counsel Robert Mullendore.

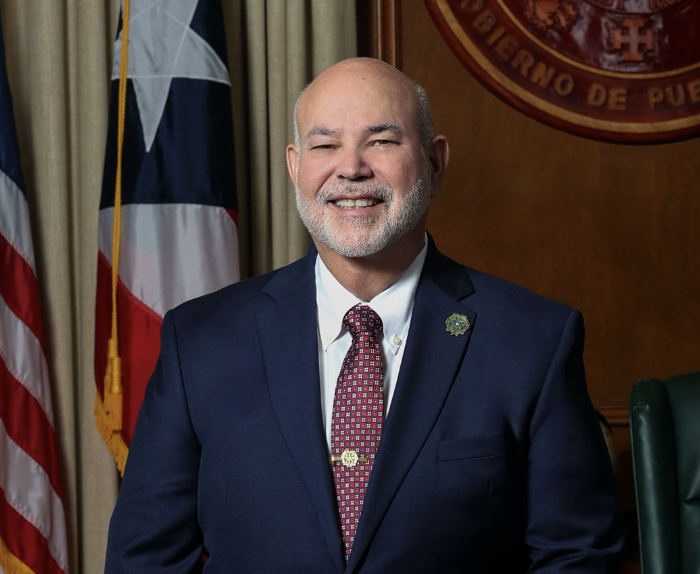

Both the former U.S. Representative from Washington state and the class counsel and settlement trustee in cases concerning federal employee compensation in non-foreign areas are hoping to change that wrongdoing. Nonetheless, they require the urgent support from Congress and political leaders from Puerto Rico. So far, Governor Ricardo Rosselló Nevares and the Puerto Rico Federal Affairs Administration (PRFAA) have expressed their strong support for the legislative proposal. However, there has been no response by the Resident Commissioner or by any member of her staff to the repeated requests for support from the duo.

This discriminatory practice also affects 2,500 surviving spouses from federal employees scattered around Puerto Rico and the ‘non foreign areas’ –as termed by the Office of Personnel Management (OPM)– such as: Alaska, Hawaii, U.S. Virgin Islands, Guam, North Mariana Islands, and American Samoa. These employees constitute around 2% of the civilian workforce.

The legislative plan, as well as the summary of aggregate effects and other background documents used for this article, state that the pay gap is a cause of the locality pay imposed in 1994 and OPM’s and Cost-Of-Living Adjustment’s (COLA) resist to change to their rate-setting methodology.

COLA payments are guaranteed under Section 5941 of title 5, U.S. Code, as well as Executive Order 1000.

When locality pay was imposed, ‘non foreign areas’ were not included in the bill, even though cost of living around these spaces is higher than in the 48 contiguous states. The document goes on to explain that in 2009, Congress believed that the Non-Foreign AREA Act put an end to discriminatory pay and benefit gaps. In reality, the budget assigned for it –a whopping $1.5 billion– was never put to use.

‘This is because, even after the locality pay program was extended to non-foreign areas by the Non-Foreign AREA Act of 2009, locality pay raises in non-foreign areas are being cancelled out by commensurate decreases in COLA. The cuts in living standards of non-foreign area employees have only become deeper. Beginning in 2010, while federal employees in the contiguous United States were receiving increasing amounts of locality pay to offset ever higher living costs, federal employees in non-foreign areas, where living costs were increasing at least as fast, were seeing their take home paychecks docked by the very same amounts,’ explain the documents.

Also stated is that the gap has widened since 1994, reaching a total difference of 19.45% in 2019. Federal employees in these areas have no union or other organizational structure. Their only effective voice has been through the litigation of four landmark cases that did not correct every aspect of OPM’s unlawful discrimination against federal employees and federal retirees in non-foreign areas.

The cases can be summarized as: Alaniz v. Office of Personnel Management, 728 F.2d 1460 (Fed. Cir. 1984), Karamatsu v. United States, No. 224-85C (Fed. Cl., 1985), Arana v. United States, No. 389-86C (Fed. Cl., 1986), and Caraballo v. United States, No. 1997-CV-27 (D. V.I.).

‘This gap represents uncompensated costs of living. It is a measure of the steady decline in the standard of living afforded by federal salaries in Puerto Rico and other non-foreign areas, compared with the standard of living afforded by federal salaries in the contiguous U.S. The equal pay gap will continue to widen unless Congress acts,’ urges the legislative plan.

Puerto Rico faces mayor inequality

According to OPM’s ‘COLA and Locality Pay Rates in Nonforeign Areas 2019’, Puerto Rico rates are among the lowest of the bunch with just 3.29% in COLA –a decrease from last year’s 3.48%– and 15.67% in locality, a slight increase from 2018’s 15.37%.

In other words, the higher the rate percentage, the higher the pay.

‘The cumulative amount of salary underpayments in Puerto Rico will reach approximately $1.6 billion on December 31, 2019 (or $2.0 billion with interest),’ state the documents.

A 2009 dated Memorandum for Heads of Executive Departments and Agencies from then OPM director John Berry exemplifies how the rates assigned to Puerto Rico (also referred to as the Commonwealth), were significantly lower than its counterparts. According to the table included in the Memorandum, rates from the City and County of Honolulu, and the U.S. Virgin Islands doubled those of Puerto Rico.

In other cases, the Commonwealth is not even singled out on tables or is grouped under ‘Rest of U.S.,’ separated from Alaska or Hawaii given that Puerto Rico is not a U.S. state but a possession under the Territorial Clause of the U.S. constitution since 1898.

Even though Hawaii and Puerto Rico registered the highest amount of federal employees and retirees compared to the rest of the ‘non foreign areas’, the authors of the proposed legislation assume that Congress will not take action on it unless Resident Commissioner Jenniffer González-Colón expresses her undeviating support.

González- Colón is Puerto Rico’s non voting representation in Congress. NotiCel tried to receive a comment from her through her press official, but the efforts weren’t successful.

According to the Chairman of the Federal Executive Association (FEA) of Puerto Rico, the ex-officio congresswoman has not responded to their request for support either. In a letter addressed to her in November 2017, chairman David Giamellaro was vocal about his opposition to the salary gap on behalf of the OPM and warned that the needed change required affirmative action.

Giamellaro mentioned that in the then upcoming 2018, federal employees in the 48 contiguous states and the District of Columbia were about to receive a pay raise of 1.9% while the federal employees located in Puerto Rico and other territories would see a smaller and unjustified raise of 1.4%.

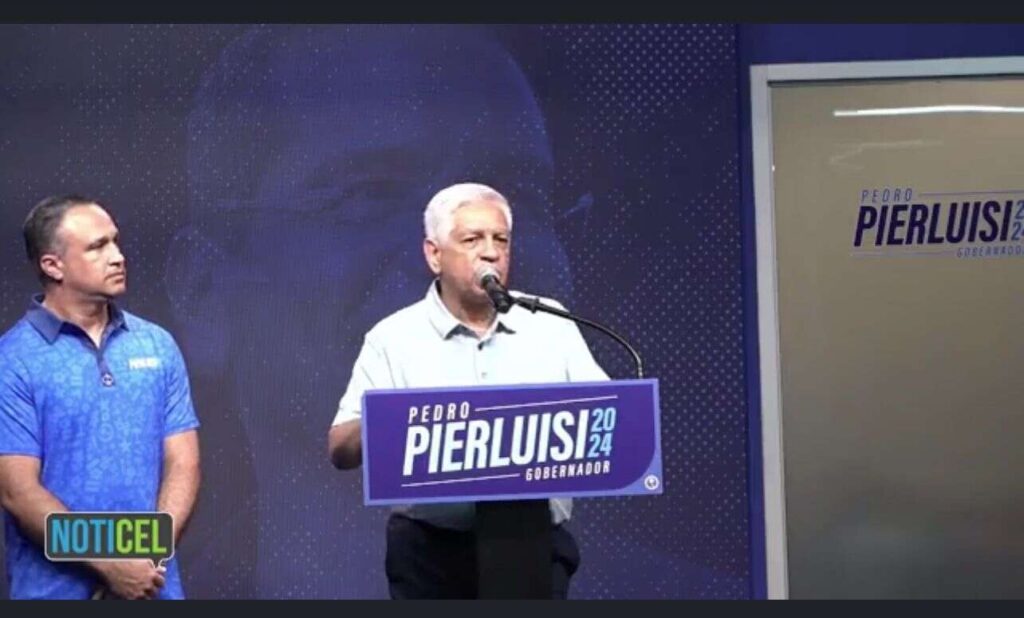

The Chairman of FEA also noted that González-Colón’s predecessor, Pedro Pierluisi Urrutia, questioned the pay disparity in a 2013 letter. Two years later, the U.S. ambassador in China, Max Baucus, backed the claim in a letter addressed to former president Barack Obama and emphasized that federal employees scattered around the territories faced higher physical risks and elevated costs of living.

PRFAA’s interim Executive Director, George H. Laws-García, assured that González-Colón’s office in Washington D.C. has been informed of the issue in order to find a solution to the problem ‘wether it’s legislative or administrative.’

Laws-García also insisted that federal employees and retirees in Puerto Rico should be treated in the same way as their counterparts working and living in the U.S.

The pay and benefits disparity is another example of discriminatory practices towards residents of Puerto Rico and other U.S. territories. In February, Judge Gustavo A. Gelpí, who presides the United States District Court in Puerto Rico, ruled that the benefits of the Supplemental Security Income (SSI) cannot be stripped away from a beneficiary just because that person moved from New York to the Commonwealth.

The decision was based on the case United States of America v Jose Luis Vaello Madero, because the federal government wanted the citizen to return $28,081 of SSI received after he moved to Loíza, one of the municipalities of Puerto Rico.

Judge Gelpí clarified that his decision was solely based on the rights of the citizen and not the political status of the Island. In that case, Puerto Rico’s Government and the Resident Commissioner actively acted as friends of the court.

Popular ahora

Bienvenido a Noticel

Empieza a crear una cuenta

Verificación de cuenta

Te enviaremos un correo electrónico con un enlace para verificar tu cuenta. Si no lo ves, revisa tu carpeta de correo no deseado y confirma que tienes una cuenta vinculada a ese correo.

Has olvidado tu contraseña

Introduce el correo electrónico de tu cuenta y te enviaremos un enlace para restablecer la contraseña.

Has olvidado tu contraseña

Le hemos enviado un correo electrónico a {{ email }} con un enlace para restablecer su contraseña. Si no lo ve, revise su carpeta de correo no deseado y confírmeme que tiene una cuenta vinculada a ese correo electrónico.

Personaliza tu feed

Verifica que tu dirección de correo electrónico sea correcta. Una vez completado el cambio, utiliza este correo electrónico para iniciar sesión y administrar tu perfil.

Elige tus temas

- Deportes

- Economía

- El Tiempo

- Entretenimiento

- Más

- Noticias

- Opiniones

- Última Hora

- Vida y Bienestar

- Videos y Fotos

Comentarios {{ comments_count }}

Añadir comentario{{ child.content }}